Taxes that come out of paycheck

Get ready today to file 2019 federal income tax returns. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Depending on where you live in the state local taxes may also come out of your paycheck.

. Other factors that can affect the size of your paycheck in California or in any other state. The form was redesigned for 2020 which is why it looks different if youve filled one out before then. To do this simply file a new W-4 and write in the extra amount youd like.

Or maybe you recently got married or had a baby. Can I deduct my moving expenses on my US. Other measures included the Paycheck Protection Program which funneled more than 500 billion to companies through the Small Business Administration to keep workers on the payrolls.

Federal estate and gift tax in Reminders. The money you contribute to a 401k plan will be deducted before taxes are taken out. You need to fill out a new W-4 every time you start a new job and you may want or need to fill out a new one after big life changes such as marriage or.

A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. An interest vested in this also an item of real property more generally buildings or housing in general.

Join Walmart for unlimited free delivery from your store free shipping with no order minimum. A In General--Section 7a of the Small Business Act 15 USC. Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The IRS urges taxpayers to use these tools to make sure they have the right.

My spouse entered the same info. It can also affect your paycheck if you pay more in health insurance premiums to cover a spouse or children. On her W4 and she had taxes withheld each pay period.

If youre filling out a Form W-4 you probably just started a new job. Since taxes will be withheld from each payment it will reduce the amount you receive weekly but can. After realizing my employer had not withheld any federal taxes all year I inquired and they said that because my dependent amount is set to 4000 no federal taxes have come out.

Property taxes vary widely from state to state and even county to county. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. In terms of law real is in relation to land property and is different from personal property while estate means.

For example New Jersey has the highest average effective property tax rate in the country at 242. For starters all Pennsylvania employers will withhold federal and state income taxes from your paychecks as well as FICA taxes. IR-2018-36 February 28 2018.

To have your unemployment checks taxed like a regular paycheck you can fill out Form W-4V. If you make pre-tax contributions to a 401k a flexible spending account or a pre-tax commuter card those contributions will come out of your earnings. I moved to the United States this year.

The amount your employer withholds will depend on the information you provide on your W-4 tax form. Uber CEO says that it will phase out gas-powered cars by 2030 Starting on Thursday Ubers comfort electric option is being. This lowers your taxable income and could be a good way for you to save on your taxes until retirement.

Owning property in Wyoming however will only put you back roughly 057 in property taxes one of the lowest average effective tax rates in the country. IR-2019-178 Get Ready for Taxes. Your household income location filing status and number of personal exemptions.

Estate or gift taxes apply to me my estate or an estate for which I am an executor trustee or representative. What is the tax rate on my income subject to US. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes.

Why would this happen. While taxes are a part of life you can play a role in how much comes out of your paycheck. One thing you can do is tweak your tax withholdings by asking your employer to withhold an additional dollar amount from your paychecks.

If youre expecting a big refund this year you may want to adjust your. If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax. These premiums will be deducted from each of your paychecks.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Personal finance is the financial management which an individual or a family unit performs to budget save and spend monetary resources over time taking into account various financial risks and future life events. Dog finds unique spot to keep an eye on her community.

These are contributions that you make before any taxes are withheld from your paycheck. How You Can Affect Your Oregon Paycheck. And B by adding at the end the following.

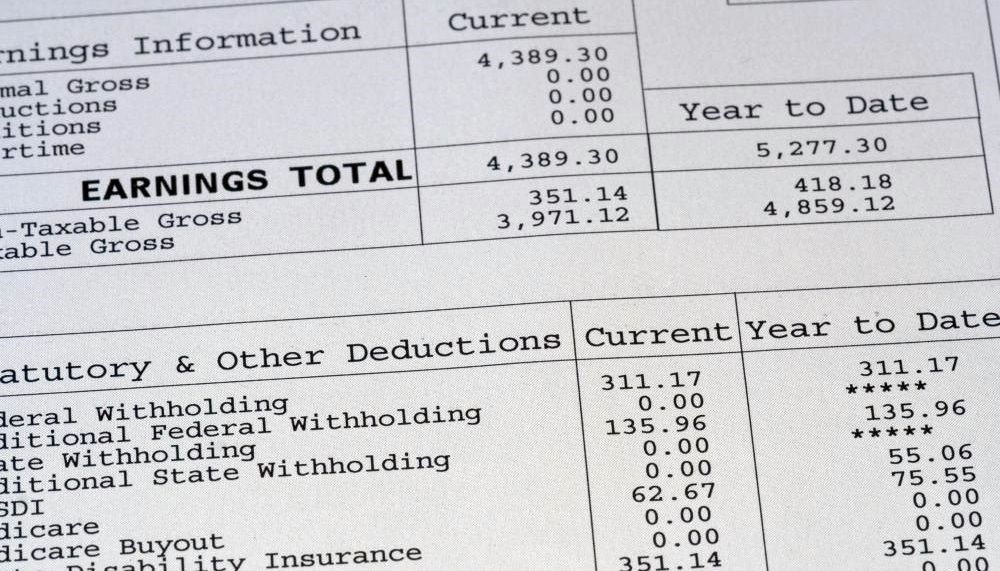

Heres a breakdown of the different paycheck taxes and why they sometimes change. Immovable property of this nature. Start your free 30-day trial now.

How Income Taxes Are Calculated. F Participation in the paycheck protection program--In an agreement. For example if your employer has a 401k plan and you utilize it your contributions will come directly out of your paycheck.

How Your Pennsylvania Paycheck Works. Federal Tax Withholding Fed Tax FT or FWT. Dems propose raising taxes on high earners to preserve Medicare.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. Key Takeaways If you expect to owe more than 1000 in federal taxes for the tax year you may need to make estimated quarterly tax payments using Form 1040-ES or else face a penalty for underpayment.

There may also be contributions toward insurance coverage retirement funds and other optional contributions all of which can lower your final paycheck. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. When planning personal finances the individual would consider the suitability to his or her needs of a range of banking products checking savings accounts.

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. 636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. Any of these far-reaching changes could affect refund amounts.

Understanding Your Paycheck Taxes Withholdings More Supermoney

Paycheck Calculator Take Home Pay Calculator

Irs New Tax Withholding Tables

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck Credit Com

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

Paycheck Calculator Take Home Pay Calculator

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Taxes Federal State Local Withholding H R Block

What Are Payroll Deductions Article

What Are Employer Taxes And Employee Taxes Gusto

Understanding Your Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Free Online Paycheck Calculator Calculate Take Home Pay 2022